The Post Office Monthly Income Scheme (POMIS) is one of the most trusted small savings schemes in India, recognized and regulated by the Ministry of Finance, Government of India. Designed specifically for individuals seeking a low-risk investment option with guaranteed monthly returns, POMIS has become one of the most popular schemes among risk-averse investors, salaried individuals, senior citizens, and homemakers.

Unlike market-linked investment options such as mutual funds or equity, this scheme offers steady and fixed monthly income by way of interest payments. With its attractive interest rate of 6.6% per annum, capital protection, and government backing, POMIS provides financial security and peace of mind to lakhs of families across the country.

The scheme is particularly beneficial for senior citizens who rely on a stable monthly income post-retirement, as well as families who wish to earn assured returns on their savings without exposing themselves to market volatility.

Objectives of the Scheme

The primary objective of POMIS is to provide citizens with a safe, reliable, and government-backed investment option that guarantees monthly income while protecting the capital.

The key objectives include:

- To promote financial security for low- and middle-income families.

- To provide regular monthly returns for senior citizens, homemakers, and individuals seeking stable income.

- To encourage long-term savings habits among the population by offering fixed returns over a five-year tenure.

- To create a risk-free alternative to market-linked investments while ensuring liquidity after maturity.

- To support individuals who prefer capital protection over high-risk profits.

Key Features of the Scheme

The Post Office Monthly Income Scheme has several unique features that make it one of the best small savings schemes in India:

- Maturity Period: The scheme has a lock-in period of 5 years, after which the investor can withdraw the entire invested amount.

- Number of Holders: The account can be held individually or jointly (maximum three holders).

- Nomination Facility: A nominee can be appointed at the time of opening the account or later. In case of the investor’s demise, the nominee receives the benefits.

- Account Transfer: The MIS account can be transferred from one post office to another anywhere in India.

- Bonus on Old Accounts: Accounts opened before 1st December 2011 enjoy a 5% maturity bonus. However, no such bonus is available for accounts opened after this date.

- Taxation: The income earned under POMIS is not subject to Tax Deducted at Source (TDS). However, the interest earned is taxable as per the individual’s income tax slab.

- Capital Protection: Since the scheme is government-backed, both the principal and interest are completely safe.

- Ease of Transaction: Simple procedures for deposit, withdrawal, and transfer ensure accessibility for all.

Benefits of the Post Office Monthly Income Scheme

- Capital Protection – Being backed by the Government of India, the investment is risk-free.

- Low-Risk Investment – Unlike equity or mutual funds, there is no market-related risk.

- Guaranteed Monthly Income – Investors receive fixed monthly interest, ensuring financial stability.

- Joint Holding Allowed – Up to three people can hold a joint account.

- Inflation-Proof Income – Even during inflation, monthly income remains unaffected.

- Easy Accessibility – Accounts can be opened in any post office across India.

- Suitable for All Age Groups – Especially beneficial for senior citizens, homemakers, and risk-averse investors.

- No TDS Deduction – Investors get the full interest without any tax deductions at source.

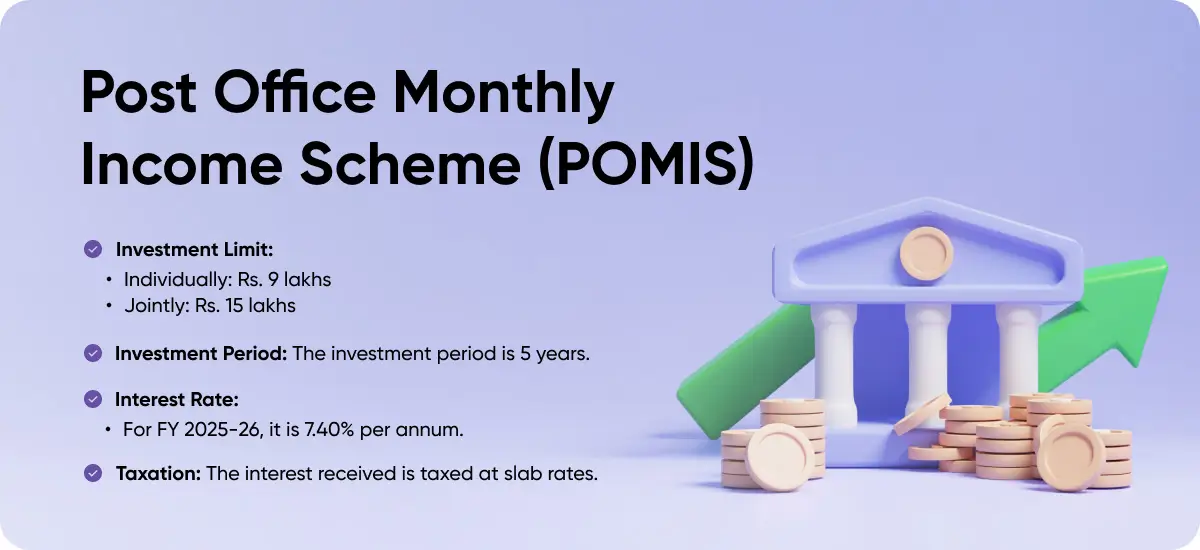

Interest Rates under POMIS

The interest rates under the scheme vary with tenure and are revised periodically by the Government. As of 2025:

- 1 year – 5.50%

- 2 years – 5.50%

- 3 years – 5.50%

- 5 years – 7.6%

Example:

If an investor deposits ₹1,00,000 for 5 years at an interest rate of 6.6%, the fixed monthly income will be ₹550.

Investment Limits in POMIS

- Single Account: Minimum ₹1,500 and maximum ₹4,50,000.

- Joint Account: Minimum ₹1,500 and maximum ₹9,00,000.

- Minor Account: Minimum ₹1,500 and maximum ₹3,00,000.

This flexibility ensures that individuals from different economic backgrounds can participate.

Eligibility Criteria

To avail of the benefits of the Post Office Monthly Income Scheme, the following conditions must be met:

- The applicant must be a citizen of India.

- The applicant must be a resident of India (Non-Resident Indians are not eligible).

- The applicant must be at least 18 years of age.

- Minors above 10 years can also open an account, but they can access it fully only after attaining the age of 18.

- Parents or guardians can open accounts on behalf of minors.

Exclusions

- Non-Resident Indians (NRIs) are not eligible.

- Hindu Undivided Families (HUFs) are not permitted to open POMIS accounts.

Application Process (Step by Step)

Offline Application Procedure:

- Open a Savings Account:

The applicant must first have a Post Office Savings Account. If not, they must open one. - Collect Application Form:

Obtain the POMIS account opening form from the nearest post office. - Fill the Form:

Enter all required details such as name, address, nominee information, and investment amount. - Attach Documents:

Submit self-attested copies of identity proof, address proof, and passport-size photographs. Carry originals for verification. - Deposit Initial Amount:

Make the first deposit of at least ₹1,500 via cash or cheque. - Nomination Facility:

Provide nominee details (Name, Date of Birth, Mobile number) for smooth transfer of benefits in case of death. - Account Activation:

Once the form and deposit are submitted, the account will be activated, and monthly interest will be credited.

Documents Required

- Proof of Identity – Aadhaar card, Voter ID, Passport, Driving License.

- Proof of Address – Aadhaar, Passport, Utility bills (electricity/water).

- Photographs – Recent passport-size photos.

- Date of Birth Proof – Birth certificate, school certificate, or Aadhaar card (for minors).

Example Calculation

Suppose an investor invests:

- ₹1,00,000 for 5 years at 6.6% → Monthly income = ₹550.

- ₹4,50,000 (maximum in single account) → Monthly income = ₹2,475.

- ₹9,00,000 (maximum in joint account) → Monthly income = ₹4,950.

This ensures a fixed, predictable cash flow for investors.

Why POMIS is Best for Risk-Averse Investors

The Post Office Monthly Income Scheme stands out because:

- It offers capital safety with assured returns.

- Provides monthly liquidity in the form of interest.

- Best suited for retired individuals, homemakers, and families needing consistent income.

- Joint holding allows higher investment limits.